In the world of finance, forex cfd trading Vietnam Brokers have gained significant traction due to their role in facilitating Forex and CFD trading. The future of trading lies in understanding the diverse strategies and tools that can help traders navigate the complexities of the financial markets.

Understanding Forex and CFD Trading

Forex trading, or foreign exchange trading, involves the buying and selling of currency pairs on the foreign exchange market. In contrast, Contracts for Difference (CFDs) allow traders to speculate on price movements of various financial instruments without owning the underlying asset. Both Forex and CFD trading have become popular methods for investors seeking to capitalize on market volatility.

What is Forex Trading?

The Forex market is the largest financial market globally, with a daily trading volume exceeding $6 trillion. This decentralized market operates 24 hours a day, five days a week, allowing traders to engage in currency transactions at any time. The primary goal in Forex trading is to profit from fluctuations in exchange rates between currencies.

What are CFDs?

CFDs are derivatives that allow traders to speculate on the price movement of an asset without actually owning it. Instead of purchasing the underlying asset, traders enter a contract with a broker, agreeing to exchange the difference in the asset’s price from the time the contract is opened to when it is closed. This method enables traders to profit from both rising and falling markets.

Key Differences Between Forex and CFDs

- Underlying Asset: In Forex, traders exchange currencies, while CFDs can be based on numerous assets, including stocks, indices, commodities, and cryptocurrencies.

- Trading Hours: The Forex market is open 24/5, whereas CFD trading hours may vary depending on the underlying assets.

- Leverage: Both Forex and CFD trading offer leverage, but the specific rates and margin requirements can differ between the two.

Advantages of Forex and CFD Trading

Both trading methods come with several advantages:

- High Liquidity: The Forex market’s vast size means that traders can enter and exit positions with minimal price impact.

- Flexibility: Forex and CFDs allow traders to go long or short on assets, providing opportunities in both rising and falling markets.

- Leverage: Traders can control larger positions with a smaller amount of capital, enhancing potential returns (though this also increases risk).

Common Strategies for Trading

Successful traders often employ various strategies tailored to their trading styles and market conditions. Some popular strategies include:

- Scalping: A short-term strategy that involves executing numerous trades throughout the day to profit from small price movements.

- Day Trading: Traders open and close positions within the same trading day to capitalize on daily price fluctuations.

- Swing Trading: This strategy involves holding positions for several days or weeks to benefit from medium-term price movements.

- Position Trading: A longer-term approach where traders hold positions for months or years based on fundamental analysis.

Choosing the Right Broker

For successful Forex or CFD trading, selecting a reliable broker is crucial. Here are some factors to consider when choosing a broker:

- Regulation: Ensure the broker is regulated by reputable financial authorities to protect your funds.

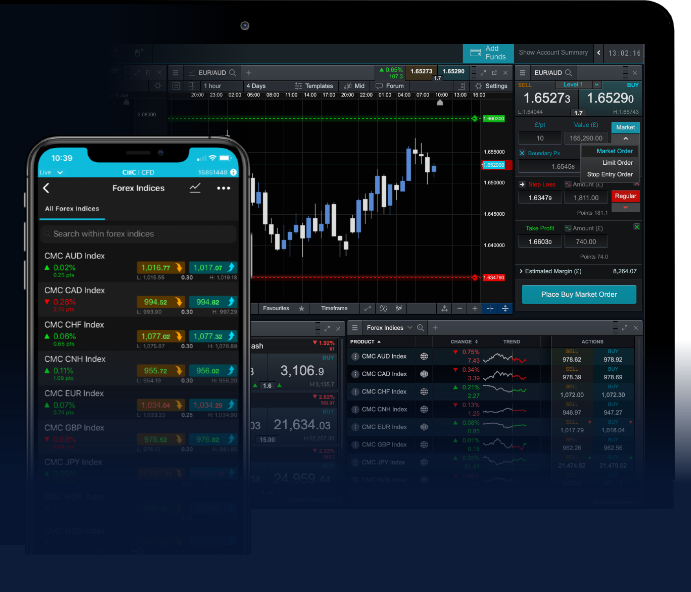

- Trading Platform: Look for a user-friendly trading platform that offers the tools and resources you need.

- Spreads and Fees: Compare the fees and spreads across various brokers to find a competitive option.

- Customer Support: A responsive customer support team can make a big difference in your trading experience.

Risks Associated with Forex and CFD Trading

While Forex and CFD trading offer numerous opportunities, they also come with significant risks. Traders should be aware of the following:\

- Market Volatility: Financial markets can be highly volatile, leading to rapid changes in prices.

- Leverage Risk: While leverage can amplify profits, it also increases the potential for significant losses.

- Emotional Trading: Fear and greed can lead to impulsive decisions, adversely affecting trading outcomes.

Conclusion

Forex and CFD trading provide exciting opportunities for traders looking to navigate the financial markets. Understanding the principles, strategies, and risks associated with these trading styles is essential for success. Moreover, partnering with trustworthy brokers can enhance the trading experience, enabling individuals to make more informed decisions. As the trading landscape continually evolves, staying informed and adaptable will be key to mastering these complex yet rewarding financial instruments.